Menu

Menu

Understand the concept of subrogation in insurance claims, its importance for insurance companies, and how it applies in cases involving faulty appliances causing house fires.

Subrogation can be a confusing term for many people when dealing with insurance claims. This jargon-busting blog aims to provide a clear understanding of subrogation when it is used in insurance claims and its importance for insurance companies. We will also discuss a real-life example involving a faulty appliance causing a house fire and present a relevant statistic on insurance claims caused by faulty appliances in the UK.

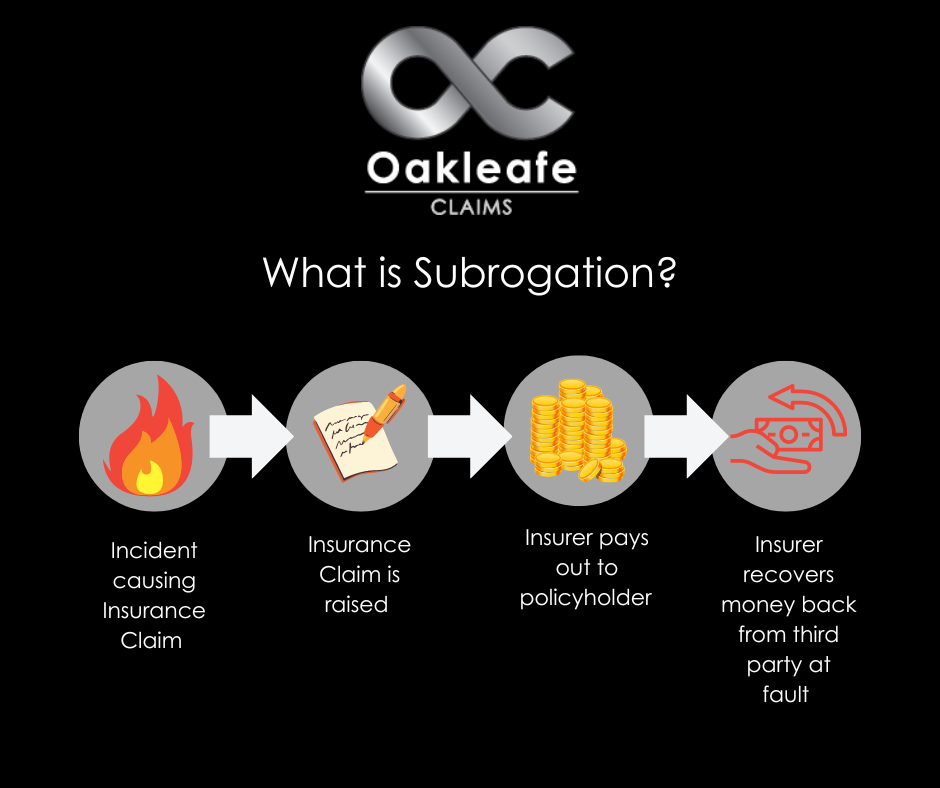

Subrogation is a legal principle that allows an insurance company to recover the money paid out to a policyholder from a third party insurance policy that is responsible for the damages or loss. Essentially, the insurer "steps into the shoes" of the policyholder and will file a claim and pursues compensation from the at-fault party. This process helps insurance companies recover their losses, which in turn can lead to lower premiums for policyholders.

Subrogation is often used when a third party is found to be at fault for causing the insured event. This can include a car accident, property damage, or in cases where a faulty product leads to a house fire.

Let's consider an example where a homeowner's insurance policy covers a house fire caused by a faulty appliance. In this scenario, the insurance company pays the homeowner's claim for the damages caused by the fire. After an investigation, it is discovered that the appliance's manufacturer is responsible for the fire due to a manufacturing defect, in tern leading to subrogation.

According to a study conducted by Electrical Safety First in the UK, nearly 60 house fires per week were caused by faulty appliances between 2019-2020. In such cases, subrogation allows the insurance company to recoup its money from the manufacturer after compensating the homeowner for their losses. The insurer may take legal action against the manufacturer to recover the money paid out in the claim, holding the responsible party accountable.

Click here to read more about dangerous appliances and how to prevent house fire

Subrogation is essential for insurance companies for several reasons:

Subrogation is a crucial aspect of the insurance claim process, allowing insurers to recover their losses from at-fault parties. This legal principle is particularly important in cases involving faulty appliances causing house fires, ensuring that manufacturers are held accountable for their actions. By understanding the concept of subrogation, you can better appreciate its importance in maintaining a fair and efficient insurance system.

White goods appliances – mainly washing machines and tumble dryers – account for as many as 60 house fires a week in the UK alone according to Which?

The number of fires has increased each year for five years.

Which? wants the authorities to tackle the issue of fire damaged properties due to appliance failure within three months. Of course the appliance manufacturers have questioned some of the data that Which? used. There is a growing fanbase of people and organisations that want an overhaul of the UK’s product safety system. This follows the series of well publicised fires such as the Grenfell Tower tragedy, which was started by a faulty fridge freezer. Fire Insurance claims rate into the millions so Insurance Claims Management Companies are being resilient to any claims and it is always advisable to get a Insurance Loss Assessor to check your policy in such an event.

One example of a defect affecting millions of tumble dryers under the Hotpoint, Creda and Indesit brands has apparently led to hundreds of fires since 2004. The Commons Business Committee made public that more than one million potentially dangerous dryers were still being used in people’s homes.

In fact a freedom of information request to fire authorities and the Home Office shows the scale of faulty appliance fires in Britain. faulty kitchen appliances have accounted for over 16,000 fires across the UK over the last 5 years.

Branded washing machines and tumble dryers accounted for one third of fires, followed by cookers and ovens, dishwashers and fridge freezers.

A series of adverts are due to be aired. This is just the first step. According to a claims management company It is essential that consumers have access to this information to let them know there is a risk of smoke and fire damage to their property. They advised the government to create a database of recalled products so people can buy based on fact when it comes to safety.

Rachel Reeves, who chairs the Business Committee, said: “While we welcomed the decision to establish an Office for Product Safety and Standards, we agree the government must make sure it has real teeth and ensure it leads to more people registering their products, a better recall regime and ultimately a reduction in the number of fires that place so many homes and lives at risk. In any case if you did suffer a fire seek the help of a Loss Assessor who will prepare and present the claim for you.

The damage caused by fires are more devastating then most people thing. Even small fires that have been contained still pose a big risk. The Smoke Particulates from Smoke Damage can still cause substantial problems to both the property and the occupants inside of it.

Electrical appliances are a significant fire risk for homeowners. Electrical appliance fire statistics show In 2020/2021, there were over 13,000 domestic appliance fires in the UK. If not treated carefully and correctly, these white goods can quickly result in a causing a fire in your home.

What Causes Appliance Fires? - There are many causes of electrical appliance fires in homes. Some of which can be easily avoided by homeowners. The most common causes are:

Many fires result from low-grade individual component parts manufactured to meet the bare minimum of standards to minimise cost.

Appliances, particularly white goods, are defined as the leading cause of fire hazards in properties at least once per day in the UK. The London Fire Brigade have publicly named some of the manufacturers in the past and pleaded with them to issue safety warnings on all ranges known to pose a risk of starting a fire. They have also asked manufacturers to encourage engineers to visit and rectify or recall any faulty appliances as soon as possible to prevent further fires.

Fire Rescue Services attended 577,053 call-outs in the year ending March 2022 compared with 518,270 the previous year. 152,608 were fires, showing an increase from 151,095.

The table below shows electrical appliance fire statistics of the ten domestic appliances that caused the most fires in UK homes in 2020/21 according to the Home Office statistics:

| Domestic Appliance | Fires in UK (2020/21) |

| Cooker (including oven) | 7246 |

| Electric hot plate / stove | 1291 |

| Grill / toaster | 1260 |

| Microwave oven | 790 |

| Tumble dryers | 542 |

| Washing machine | 456 |

| Deep fat fryer | 238 |

| Dishwasher | 224 |

| Fridge / Freezer | 202 |

Cookers such as your electric ovens caused over 7000 fires in the UK in 2020/21, the most of any domestic appliance. Cookers and oven fires are often caused by leaving food or food scraps inside them unattended. If you suffer an oven fire, you should immediately:

Electric hot plates or stoves, caused the second most domestic appliance fires in the UK in 2020/21, with over 1200 cases. It is essential that before using your stove, you clean off any grease and flammable grime before turning off the heat. A dirty stove is a fire risk.

Grills and toasters were also responsible for over 1200 fires in the UK in 2020/21. Placing these close to anything that can burn is always risking a fire. A faulty toaster that fails to turn off is also a common cause of home fires. It is sensible to unplug these kitchen appliances when they are not in use to avoid these potential fire risks.

Almost 800 fires in the UK were caused by microwaves in 2020/21. As you can imagine, placing metal pieces in the microwave, sometimes found in food packaging, is likely to cause a fire. Clean all remaining food, a build up of food poses a potential fire risk. You should also avoid overheating ingredients in a microwave. Never leave anything in the microwave unattended.

Tumble dryers were the cause of 668 fires in 2019/2020. To help with fire prevention, we have provided you with some simple steps to follow to help with this. Remove lint from the machine after every load of clothes that you dry. Do not cover any vent or opening on the device. Sweep or vacuum areas around the dyer to prevent fluff build-up. Do not use it while sleeping or when away from home.

To reduce the risk of fire, when using kitchen appliances or any electric appliances, always keep a close eye on them. Leaving them unattended increases the risk of a severe fire breaking out and reduces the chance of you preventing it.

When you leave your house, turn appliances such as tumble dryers and washing machines off at the socket to reduce risk.

If you plan to purchase new appliances, particularly white goods, google to research if there are any warnings about their history of starting fires before you commit to the order. You can search online for your appliances or directly with the manufacturers to ask about fire safety warnings associated with the unit.

Many people are unaware of the toxicity of smoke damage after an appliance fire. Temperatures in even the smallest of fires regularly exceeds 1000 degrees centigrade.

However, it’s not just heat that causes damage. Smoke is insidious and remains a significant problem long after extinguishing a fire. The dangers of smoke damage can be grave to people and properties.

If you suffer an appliance or electrical fire in your home, be sure to give us a call. Oakleafe Claims deal with many house fire Insurance Claims and can help you get your home back to its pre-fire condition.

If you have been declined whilst trying to claim on your domestic or commercial insurance, we can help. We can also help with professional services, for example, Brokers, VAR Valuations and Managing Agents.